Insights

Exploring the World of Surplus Lines Homeowners Insurance

When it comes to home insurance, surplus lines insurance stands as a critical and often misunderstood component. Understanding the unique aspects and significance of surplus lines insurance is pivotal in offering comprehensive services to insurance professionals specializing in high-risk property insurance. This article unravels the complexities of the surplus lines market, setting the stage for...

Common Gaps in Watercraft & Yacht Coverage

An insurance agent needs to be able to identify the best policy for a client and ensure they have all the coverage they require. If they don’t read the fine print closely or gather enough information about the client’s risks, the client could end up with gaps in their coverage, leaving them vulnerable to unpaid claims. When it comes to...

Ice Dams: Help Your Clients Reduce Claims From This Type of Weather Damage

Untouched snow on the roof of home looks pretty, but this winter's heavy snowstorms mixed with frigid temperatures can cause an ice dam to develop on that roof. Ice dams prevent melting snow from properly draining. This can cause serious damage to insulation, ceilings, and walls if the water seeps inside the home. ... which leads to that...

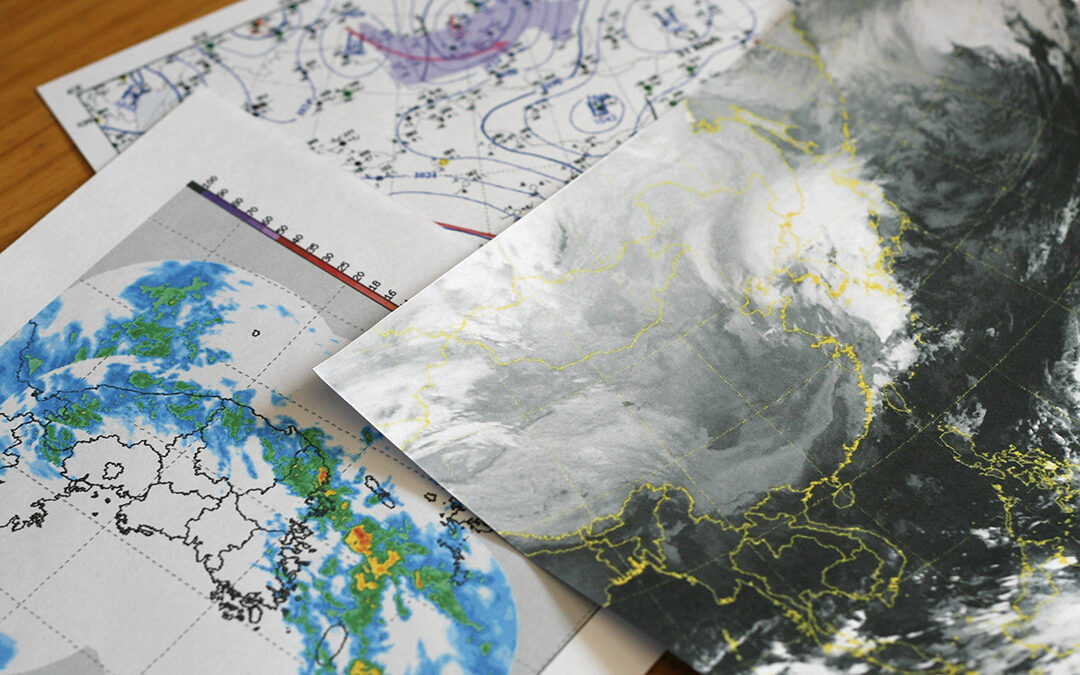

Why FEMA Maps Can’t Determine People’s Need for Flood Insurance

Extreme floods are exposing issues in the Federal Emergency Management Agency's (FEMA) flood maps, according to a recent article by the Washington Post. Americans rely on these maps to warn about potential flood risks, but that’s creating dangerous situations for residents around the country as it leaves them uninformed about the potential...

Get to Know Jonathan Sweeney, Director of Personal Lines as Quaker Special Risk

Meet Jonathan Sweeney, Director of Personal Lines as Quaker Special Risk. Jonathan has deep expertise spanning over two decades in the insurance industry. In this spotlight video you’ll learn what Jonathan enjoys and what challenges him most about his role at Quaker. You’ll also learn some fascinating facts about his life before insurance! ...

How to Mitigate Liquor Liability During the Holidays

Holiday festivities often center around a toast. So, it’s no surprise drunk driving incidents increase this time of year. Whether your clients serve beer, wine, or cocktails, education is the best way to protect them from liquor liability. A comprehensive training program can prepare staff members for this merry time of year, so here are a few...

Top Five Examples of Directors and Officers Coverage Claims

Twitter recently agreed to pay out $809.5 million in a class-action lawsuit settlement that alleged its executives made inaccurate statements about the site's metrics. When the company's stock took a dive, investors were up in arms over the loss. With settlements hitting these kinds of heights, it's no surprise that the market for D&O...

What Is Tech E&O Coverage and Who Does It Cover?

When automobile autopilots cause a fatal crash, facial recognition software leads to the arrest of the wrong person, or an AI-led recruiting tool shows bias against women, those held liable usually end up having to dole out big bucks to the injured parties. Instances like these are just some of the reasons businesses need Tech E&O (errors and...

What Happens When Your Credit Card Is Swiped

Cash payments declined to 18.6%, down from 25.8% in 2019, according to the latest data. Digital payments, including the use of credit cards, continue to grow, and so does the fraud associated with them. According to the FTC, there were over 4.7 million reports of fraud recorded in 2020. And just recently, the details of 1.2 million stolen credit...

8 Cybercrime Trends to Watch Out for in 2023

Although there may be a few frightening characters who show up at your door this Halloween, cyber threats are far scarier (and not likely to be appeased by just a few pieces of candy). The FBI reports that in the US alone, potential losses from cyber crimes exceeded $6.9 billion in 2021. In the spirit of Cyber Awareness month, we’ve rounded up 8...

Top 10 Trends in In-Home Businesses

Throughout 2020 and 2021, numerous small businesses shut their doors and instead decided to sell their products online. For millions, in-home businesses have proven to be highly lucrative, especially in the age of social media. Today, many small business owners continue to operate entirely from the comfort of their own homes. In-home businesses...

Top Trends in Super Yacht Design

Super yachts differ from traditional yachts in that they're typically much longer and more spacious. … And based on all their bells and whistles, designing a coverage plan for one could get tricky. Over the years, these unique luxury yachts have undergone numerous changes, and they continue to boast state-of-the-art technology and ever-increasing...

Understanding Types of Ownership and Insurance Coverage Options

Trusts, estates, LLCs, and family limited partnerships are just some types of ownership used for properties and assets. They're gradually becoming more common because they're a good option for wealth management and the transfer of legal ownership for properties such as rental properties, personal homes, and vacation homes. The benefits of these...

Do Your Clients Need Condo Insurance Coverage?

Condo insurance protects condo owners from damages to their unit and to their personal belongings. If your clients own a condo, they may think that their condominium association master insurance policy is enough to cover their home; however, that's not the case. The master policy usually protects the exterior of their unit and other common areas...

A Guide to Collectible & Personal Article Floaters

It's a common misconception that Homeowners', Renter’s, and Dwelling policies cover all personal property, but that's not the case. While they cover some personal effects, there are often limitations and exclusions on what the policies will pay out, meaning homeowners and renters may receive less than their belongings’ value. Collectible and...

Do Your Clients Need Coastal or High-Value Homeowners Insurance?

If your clients own a coastal or high-valued home, standard homeowners insurance may not provide adequate coverage if an unexpected event occurs. Standard middle-market policies leave expensive gaps in coverage for homes that hold high values, typically over $750,000, or home that are located along the coast, in areas vulnerable to disastrous...

2021’s Top Judicial Hellholes

Throughout the U.S., lawsuit abuse accounts for more than $160 billion in high tort costs and an estimated loss of $143.8 million in lost wages. With such staggering numbers, one particular organization, the American Tort Reform Foundation (ATRF), established the Judicial Hellholes program to gather and report information on various abuses within...

Do Your High-Risk Clients Need Excess & Surplus Insurance?

Suppose one of your clients is an arborist, who works with dangerous equipment – and in hazardous conditions – regularly. Or you’re working with the owner of a large concert venue who is worried about the risks of hosting large events with huge crowds. In cases like these, insurance carriers may refuse to offer standard coverage due to the higher...

The Ins and Outs of Product Liability Insurance

Businesses that distribute, manufacture, and sell products must do their due diligence to ensure that they are free of defects. Unfortunately, despite the level of care and effort put into their operations, the possibility for errors remains, leaving the company open to potential claims and lawsuits. Product Liability insurance acts as a safety...

What’s the Difference Between Artisan and General Contractors?

Artisan and General Contractors play critical roles in the building industry. Keep reading to learn more about the differences between the two positions, potential risks, and insurance needs. General Contractors General Contractors are typically responsible for overseeing big picture projects, including renovations, expansions, and new...

Should Your Clients Sign a Waiver of Subrogation?

A Waiver of Subrogation is an agreement between two parties where one party agrees to waive subrogation rights against the other in the event of a loss. In other words, the person who adds this waiver onto their policy is waiving their right to sue the party they added, even if that party was negligent. A Waiver of Subrogation is commonly...